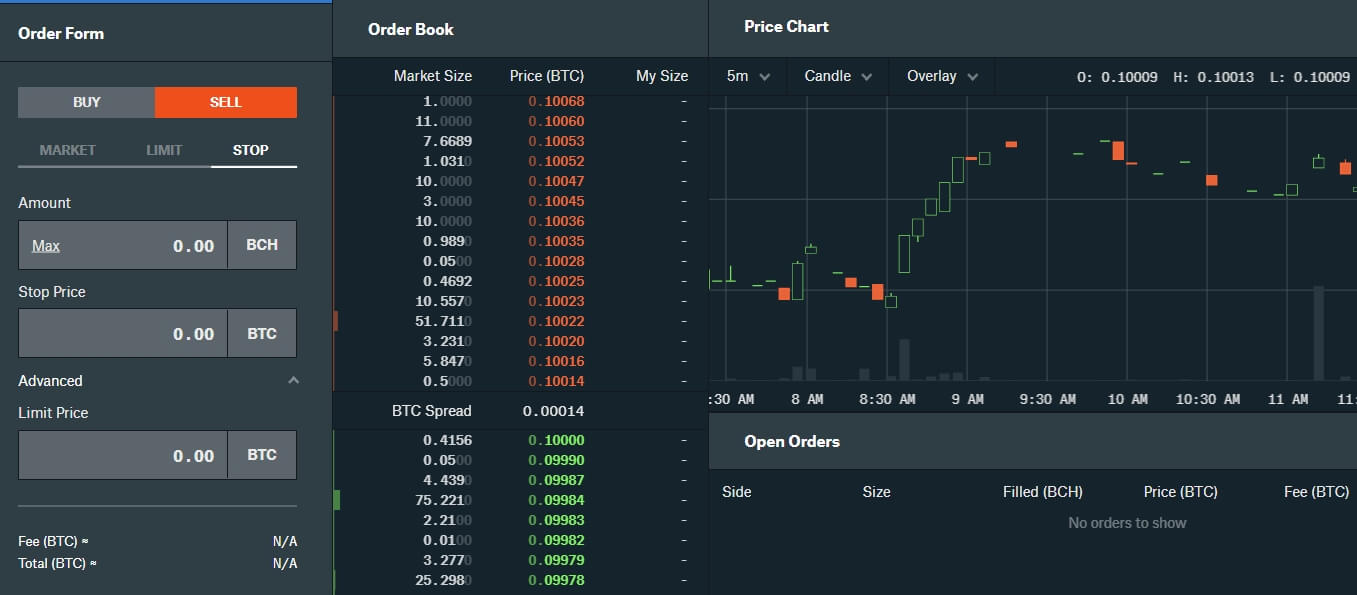

If you are doing a trade on a 5min - 30min timeline, you would set a stop-loss at around 5% below your buy price. This is totally up to an individual trading style. So basically the shorter the timeframe you are doing the trade in, the tighter your stop-loss would be. This method is the one that I do not recommend, although many trades use this to set their stop-loss orders. There are two ways we can set our stop-loss orders: 1. Now we can look at what sort of strategy we can use around it.Ĭomment: Strategize your Stop-Loss order priceįor this part we will look at the chart above. That was just the intro on what Stop-Loss actually is. We will discuss that strategy in the next topic below. You are correct, but it is extremely important at what price you set your stop loss order at. What if the coin doesn't keep going down from that level. I know what you might be thinking right now. The benefit of this is that it cuts your losses if the coin keeps going down from that level. So now once your coin goes below 20000, the system will automatically open a sell order at your set limit price which in this case is 19000.

Now lets say you buy a coin at 23000, and after you buy it, you set a stop-limit sell order with a Stop price of 20000, and sell (limit) price of 19000. Refer to the link above to see a image of how stop-loss looks like on Binance. In simple terms, lets look at an example below.

Now, if the coin goes below $8, and if you have a Stop-Loss order up, it will open a Limit Order at the limit price you gave once the price reaches below your set Stop-Loss price. Basically if we buy a coin at $10, and you set a stop price at $8. What is a Stop-Loss order?Ī Stop-Loss order is an order set by a trader which will sell the coin if its price reaches below a set price (Stop Price) in this case. Keep in mind this is extremely important to cut your losses especially when we are not sure about the direction that BTC is heading in.īelow are the topics we will go over today: What is a Stop-Loss Order?ĭisadvantages of Stop-Loss Note: For the above topic, please refer to the BTC chart above. I will go over this in a simple way so you can understand this topic really well. If they had set up a stop-loss order, they could've bought the coin at its lowest, and then earned all those profits in lesser time.ĭon't you worry. If they had a stop-loss order opened up, they would have been out at a minimal loss rather than waiting few months for the coin to come back up. They did not had a stop-loss order opened after they bought a coin. Believe it or not there are many people out there who are still holding that coin because of just one mistake. But instead, it just keeps going down more and more.

A lot of people face a situation when they buy a coin at a higher price, and it just starts going down, and you just hold it in the hopes that it will go up soon. This one is a must needed for any trader, and it is extremely important to get this right. I am back with yet another helpful lesson for y'all.

0 kommentar(er)

0 kommentar(er)